Mastering Forex EA Trading: Tips and Strategies

Welcome to the world Forex EA trading! this article, we will some valuable tips and that can help you become master in this exciting. Whether you a beginner or an trader, these insights will you with the knowledge navigate the complex world of trading robots, also as Expert Advisors.

Forex EAs

Visit Our Website www.botsfirm.com

Before delve into the tips strategies, let’s start understanding what Forex E are. Forex E are computer programs designed to trading operations in the exchange market. These EAs use pre-defined algorithms and trading strategies to analyze market conditions and execute trades on behalf of the trader. They can access real-time data, monitor multiple currency pairs simultaneously, and react to market fluctuations faster than human traders.

Choosing the Right Forex EA

The success of your Forex EA trading largely depends on selecting the right EA for your trading style and goals. Here are a few key factors to consider.

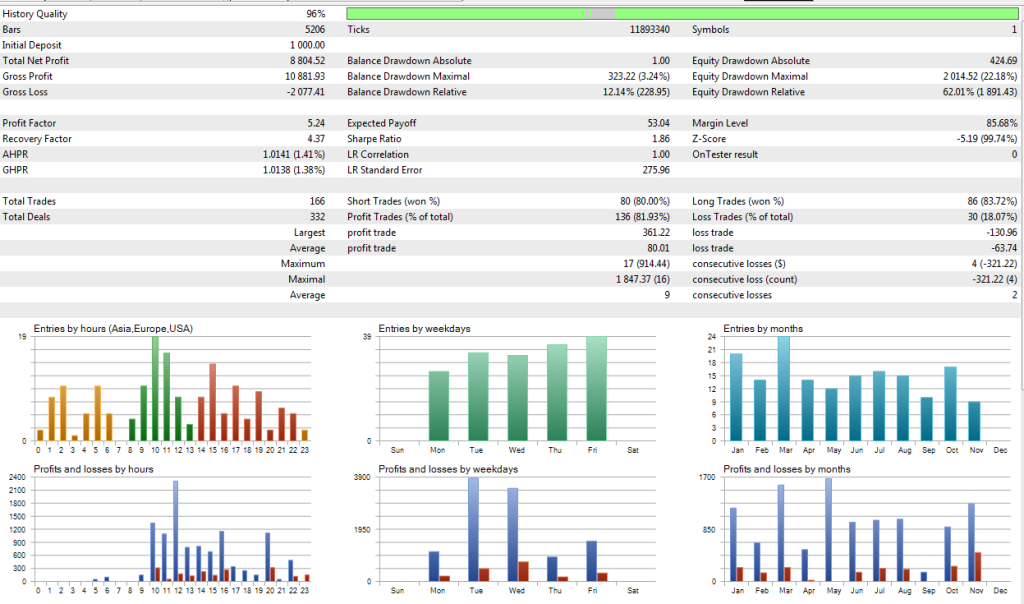

Performance History

Look for EAs with a proven track record of consistent performance. Analyze their historical data and assess their profitability, drawdowns, and risk management. A good EA should have a balance between profit potential and risk mitigation.

Visit Our Website www.botsfirm.com

Strategy and Customization Options

Consider the trading strategy used by the EA and evaluate if it aligns with your trading objectives. Additionally, look for EAs that offer customization options, allowing you to tailor the strategy to suit your risk tolerance and preferences.

Support and Updates

Choose an EA from a reputable developer or vendor who offers regular updates and reliable customer support. This ensures that you have access to the latest features and bug fixes, and can seek assistance in case of any issues.

Optimizing EA Settings

Once you have selected an EA, it’s essential to optimize its settings to maximize its performance. Here are some tips to help you with the optimization process:

Backtesting

Before deploying your EA in live trading, conduct thorough backtesting on historical data. This enables you to assess how the EA would have performed in various market conditions. Make sure to use quality data and consider different time frames to get a comprehensive analysis.

Parameter Optimization

Experiment with different parameters within the EA to find the optimal settings for your trading strategy. It’s important to strike a balance between risk and reward, and avoid over-optimization, which can lead to poor performance in real-time trading.

Risk Management

Successful Forex EA trading involves effective risk management to protect your capital and minimize losses. Here are some risk management strategies to consider:

Proper Lot Sizing

Determine an appropriate lot size for each trade based on your account size and risk tolerance. Avoid overleveraging, as it can amplify both profits and losses. Implementing a proper lot sizing strategy helps to control risk and maintain consistency in your trading.

Stop Loss and Take Profit Levels

Set clear stop loss and take profit levels for each trade. This ensures that your losses are limited, even if the market moves unfavorably. It’s essential to use logical levels based on technical analysis and avoid arbitrary values.

Diversification

Avoid overexposure to a single currency pair or market by diversifying your portfolio. Investing in multiple EAs with different strategies or incorporating manual trading alongside EAs can help mitigate risk and increase the chances of overall profitability.

Continuous Learning and Adaptation

The Forex market is dynamic, and successful traders need to adapt to changing market conditions. Here are some key principles to embrace:

Analysis and Evaluation

Continuously analyze and evaluate the performance of your EAs. Identify patterns, assess the impact of market events on their performance, and explore opportunities to improve their effectiveness.

Staying Informed

Stay updated with the latest industry news, economic indicators, and geopolitical events that can influence the currency markets. This information can help you make informed decisions and adjust your trading strategies accordingly.

Embracing Flexibility

Be open to adjusting your trading strategies and considering new EAs or modifications to existing ones. Flexibility is key in adapting to changing market dynamics and maximizing your chances of success.

Conclusion

Mastering Forex EA trading requires a combination of technical knowledge, effective risk management, and continuous learning. By choosing the right EA, optimizing its settings, implementing robust risk management strategies, and staying adaptable, you can enhance your chances of success in this dynamic market. Remember, the path to mastery is not without challenges, but with dedication and persistence, you can unlock the potential of Forex EA trading.

Visit Our Website www.fxplanets.com