How To Use Forex Robots

How to Use Forex Robots (EAs), sometimes referred to as automated trading systems or forex robots, are becoming more common among traders who want to automate their trading methods and take advantage of the chances in the forex market. These computer programs are made to carry out trades on the trader’s behalf according to preset standards, saving manual intervention. This is a thorough approach to using forex robots efficiently.

Understanding What Forex Robots Are

It’s critical to comprehend what forex robots are and how they work before utilising them. Algorithms designed to evaluate market conditions, spot trading opportunities, and carry out trade execution automatically are known as forex robots. Technical indicators, past data, and trader-specified rules are the foundation upon which they function.

Choose the Right Forex Robot

You must choose the appropriate forex robot if you want to succeed at automatic trading. Take into account the following aspects while selecting a forex robot:

Performance History: Choose a robot with an established history of success. Examine past performance statistics to make sure it has performed well in a range of market circumstances.

Make sure the robot’s trading approach is compatible with your trading objectives and risk tolerance. While some robots are more appropriate for long-term trading, others may be more focused on scalping.

Customization Options: You can modify variables such as trade size, risk level, and indicators used with the finest forex robots.

User Testimonials and Reviews: Read through user testimonials and reviews to get an idea of other traders’ experiences with the robot.

Choose a Reliable Broker and Trading Platform

A Broker will supply a trading platform for your forex robot to use. Selecting a trustworthy Broker with a solid reputation, minimal latency, and automated trading support is therefore crucial. The most popular platforms for forex robots are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which provide strong support for EAs.

Backtest the Forex Robot

Backtesting a forex robot is essential before using it in a live trading environment. Backtesting is using historical data to assess the robot’s performance in various market scenarios. Through this procedure, you can discover any potential flaws or places for improvement in the robot’s performance as well as how it would have operated in the past.

Optimize the Robot’s Settings

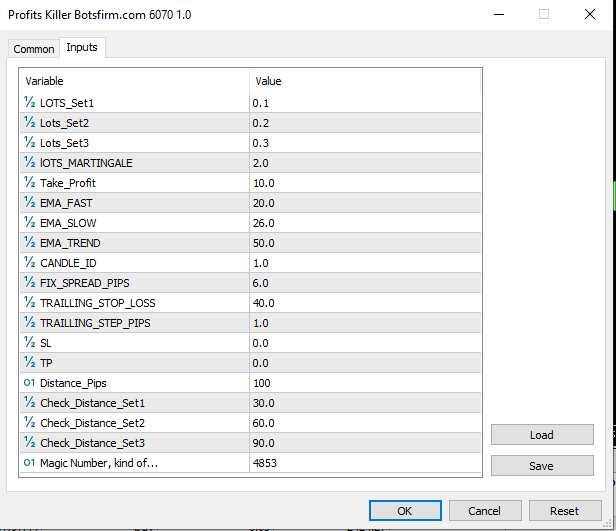

The next stage is to tweak your forex robot’s settings after you have chosen and backtested it. This entails modifying variables like:

- Risk Level: Determine the amount of capital you’re willing to risk on each trade.

- Trade Size: Set the lot size or position size for each trade.

- Trading Hours: Define the hours during which the robot will operate, such as avoiding trading during news events or low-liquidity periods.

- Stop-Loss and Take-Profit Levels: Establish stop-loss and take-profit levels to manage risk and secure profits.

Monitor the Robot’s Performance

Forex robots are meant to work independently, yet constant observation is necessary. Make sure the robot is operating as intended and placing lucrative trades by keeping a watch on its performance. It could be necessary to change the robot’s settings or even temporarily stop trading if it begins to perform poorly or deviate from your expectations.

Stay Updated with Market Conditions

Technical analysis and historical data are the usual foundations for forex robots. However, a number of factors, including economic data releases and geopolitical developments, can cause market conditions to shift quickly. It will be easier for you to decide when to change the strategy or parameters of your robot if you keep up with these advances.

Start with a Demo Account

You should start with a demo account if you’re new to using forex robots. You can try the robot with virtual money in a risk-free setting with a demo account. By doing this, you can have a better grasp of the robot’s functionality and potential profitability without having to risk any real money.

Transition to Live Trading Gradually

You can switch to live trading if you’re satisfied with the robot’s performance in the demo account. To reduce risk, start small and progressively increase your investment as you become more knowledgeable and assured of the robot’s abilities.

Practice Good Risk Management

Trading automatically does not remove risk. Effective risk management is crucial, and it involves diversifying your trades, establishing suitable stop-loss levels, and never taking on more risk than you can afford to lose. Keep in mind that over-optimizing the robot’s settings can result in overfitting, which makes the robot perform poorly in live trading but well in backtesting.

Conclusion

For traders looking to automate their trading techniques and take advantage of market chances without continual supervision, forex robots can be an effective tool. However, cautious selection, exhaustive testing, frequent monitoring, and strict risk management are necessary for the effective usage of forex robots. You may improve your trading experience and possibly boost your forex market profits by adhering to these guidelines.